Universities and Crowdfunding: Meant for Each Other

Universities and crowdfunding go together like millennials and texting: inseparable and dangerous while driving. But to truly understand the relationship between universities and crowdfunding, it is important to first understand the people most heavily involved: those who are ages 18–35, AKA those who grew up with the Internet.

Millennial Demographic

This demographic is made up of technological trendsetters and breakers of prior paradigms. Crowdfunding is especially effective when in the hands of inventive and modern thinkers, able to harness the power of social media and the now ubiquitous video-pitch.

College students have grown up with instant gratification at their fingertips such as texting and Netflix. Crowdfunding capitalizes on this need for instant gratification by allowing companies to quickly acquire the financial backing they need while simultaneously providing customer traction. Let’s summarize the relationship between universities and crowdfunding like Abraham Lincoln did of the government: crowdfunded companies are of the people, by the people, and for the people. It’s a simple concept.

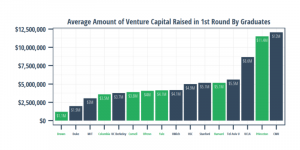

Universities and Crowdfunding

Universities have always churned out start-ups. VC backing, however, only comes with a couple investors and no new customer traction.

The new crop of companies looks to alternative methods to financing, like crowdfunding, to gain popularity and make hundreds of connections through brand ambassadors.

“With VC investing, the only people that believe in the company is the investor and the person who started the company. If a lot of people invest in a company, there is a better chance that that idea will succeed because many people believe in it.” — CEO of StartEngine Ron Miller

Intra-University Crowdfunding

With the industry shifting, Regulation Crowdfunding now allows the average person to invest in a crowdfunded start-up. So what?

This could lead to the immediate rise of in-house crowdfunding. Universities could partner with equity based crowdfunding platforms like StartEngine as their intra-university platforms. With this, only university students and alumni will be able to invest in the startups that grow out of their own institutions.

The Incentive for the University and Investors

Exclusive crowdfunding makes sense for a few reasons: First, colleges have large and passionate alumni bases that would proudly give back to their alma mater. For example, the University of Southern California has over 375,000 living alumni who are willing to support their Trojan Family. Second, universities love to put the face of any success story from their institution in their magazines, advertisements, and websites. Third, the majority of a start-up’s investors will be their own alumni and students, which can serve as a major ego booster. As an added bonus, all the alumni and students that are willing to invest are only exposed to their college’s start-ups; university-bred start-ups won’t have to compete with a million other companies for exposure like they would on other popular crowdfunding sites. It’s a win-win situation for both parties.

The Incentive for Student Run Start-ups

Intra-university crowdfunding would primarily benefit the students. University entrepreneur classes would exchange case studies for real startup competitions. Students would have to create an on-campus business and receive a certain amount of funding in return for revenue sharing. Moreover, the barriers to entry would crumble and there would be a massive influx of resources, mentorship, and events across all majors to facilitate the emergence of start-ups. The possibilities are endless here.

It is For Everyone

Entrepreneurship is definitely not confined to business people in the business school; people across all industries trying to improve the world can grasp it. That is what start-up companies do. They find a problem then provide a solution that people want. Intra-university crowdfunding will bring those dreamers closer to the resources that will help them execute. We soon will be living in the renaissance of start-ups.

The views and opinions expressed in this article are those of author Hailey Hite. Readers should not consider statements made by the author as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please go to:https://blogstartenginecom.kinsta.cloud/assets/Disclaimer.pdf