The IPO is Dead. Long live the OPO!

It is well known that Wall Street really serves the people in the know. What it should be is a free market where all of the information about a stock is released publicly and everyone has the same data to make investment decisions. Yeah right! Wall Street has created a nice uneven playing field and good luck to the ordinary “dumb” investor. One area where Wall Street feeds good opportunities to the general public is through Initial Public Offerings or what the industry calls IPOs. When a company needs to raise capital, instead of going to wealthy private investors, institutional investors or banks, for that matter, they go and list their company on one of the public exchanges: NASDAQ, NYSE, etc. This is a great way for a company to access capital and a great way for investors to come in early on the action and invest their money.

The investment banks take a nice chunk of money for the service of taking a company public and the general public finally has an opportunity to invest with a reasonably level playing field. Think about some of the greatest returns from IPOs of the past: Microsoft, Apple, Amazon, etc. Investors who are patient can be heavily rewarded with returns hundreds of times their initial investment. Nice! However, something different has happened with IPOs in the last few years. Companies are going public much later and thus asking for much larger valuations. The ordinary investor can now only expect a 5 times return with the Facebook IPO when the original investors got a return of 500 times on their investment.

IPOs biggest hits

In 1986 Microsoft went public and raised $60M. Apple raised $100M in 1980. Amazon raised $54M in 1997. This is $1.7B less than Twitter raised 16 years later. The large investment banks decided to focus on very large offerings and locked out the smaller ones. Small companies can raise capital from private equity firms, venture capitalists and angels. Basically, the sharks, those who call themselves “smart money” and like to take “dumb money” and invest it.

Why is the IPO in the doldrums ?

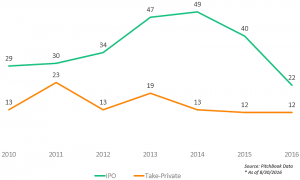

PitchBook, which publishes technology research, has compiled a list of technology IPOs in the last six years. As you can see, the IPO is on a rapid negative trend.

If you subtract the 22 IPOs for this year by the 12 companies going from public to private, you will see that only a net 10 companies were added to the stock markets- a very small number for the US economy.

The key reason I see for this depressed IPO market is investment banks only want to take public large and fast growing companies. They changed their business to cater to the largest startups. They claim the costs for an IPO are too high for smaller companies.

Online Public Offerings to the rescue

Guess what ? There is now an alternative that is several orders of magnitude less expensive and can still achieve the goal of raising capital for companies. Online Public Offerings are new in the last 12 months. The reason they are less expensive is because they do not require large investment banks or huge legal fees to complete. They are online which is less expensive. No commissions paid to stock brokers, no analysts, no traders, no bankers, no big fancy offices, no jets flying the management team around to pitch investors, no investor dinner parties or taking clients to strip clubs. The Online Public Offering is now the solution for small companies to get the capital they need to become successful.

Everybody wins

One of the nice things that happens when new regulation comes in and shuffles the deck is you find benefits for all sorts of people. For example, an angel who invests into a hot startup will likely never see that company go public- more likely it will be sold to another well funded company. This means the angel investor will probably take much less from the sale than an IPO because the IPO prices the company in an open marketplace. The sale to another company does not uncover the true value of the investment. The same argument goes for venture capitalists. In the past, the VC preferred a company go public and then distributed the proceeds in shares to its limited partners. This way they maximized the value for their investors and themselves.

Elio Motors is the first large Online Public Offering

The Online Public Offering started on June 19th of 2015 with a big bang. Elio Motors listed on StartEngine and raised $17M from 6,600 investors. Thereafter many more companies raised capital with OPOs. As of today, way more companies raise capital with OPOs than IPOs. You will soon see IPOs being eclipsed by OPOs and ordinary investors having access directly to investment opportunities. Clearly they are risky and investors should consult their professional advisors to better understand how much of their assets to invest. But for the first time in 80 years, the ordinary investor will play on the same level as the “smart” professional investor. Democratization of capital is a good thing for everybody.

If you liked what you read, follow me on Medium to get notified when I publish new stories. Also, hit the heart button below so that others see this story.

The views and opinions expressed in this article are those of author Howard Marks. StartEngine Crowdfunding is a not a broker-dealer, funding portal or investment adviser. StartEngine Capital, LLC is a funding portal registered with the US Securities and Exchange Commission (SEC) and a member of the Financial Industry Regulatory Authority (FINRA). Neither StartEngine Crowdfunding nor StartEngine Capital is making any recommendation or giving any advice with respect to any company or offering discussed in this communication. To read our full disclosure, please go to: https://blogstartenginecom.kinsta.cloud/assets/Disclaimer.pdf